First you have to assure that your company qualifies for SEIS . The eligibility criteria of a company applying for SEIS is discussed above.

Expert Guidance for SEIS & EIS: Tailored Solutions for Tax-Efficient Investments at Taxaccolega

Seed investment enterprise scheme or seis is a scheme introduced by the government to help small or medium sized companies attract investments and grow. In return, the eligible investors(usually the private investors ) get generous tax relief when they buy new shares in the company. This scheme is especially beneficial for startups looking to raise funds and increase their capital.

SEIS is very similar to another type of funding EIS. The main difference is that SEIS is ideal for very early stage startups while EIS is more suited to established businesses needing growth. If an investor wants higher tax relief they may choose SEIS however, if the investor wants to invest large sums but in mature companies they may choose EIS.

To be able to secure funding through SEIS your company should have the following:

As envisioned, income tax professionals have a broader view as to what issues need to be managed. When it comes to filing a return or adjusting the page of a governing document, the quality is guaranteed. There are things we can take pride in, such as coping with rapid changes in the area of tax regulations, especially after Making Tax Digital (MTD) came into practice.

As your personal income tax accountant, we will collaborate and conduct sessions with you to ensure that all aspects of your income tax obligation are effectively dealt with so that you have the freedom to pursue more important things in your life, like growing your business or enjoying the leisure.

The investors are usually individual investors who are paying UK income tax but are not necessarily UK residents. You can check HMRC website for more information on UK residents. The investor should not be connected to the company. For example, the investor cannot be an employee of the company he is investing in, he cannot be the partner of the company or the director of the company before investing in the company although he can be a director after investing in the company. The investor cannot even be the family members of the directors or the employees of the company otherwise they will be considered connected and therefore they won't qualify as an investor for SEIS.

Maintaining books and keeping ledgers up to date daily, on the one hand, is extremely important and will save you from a lot of difficulties, but it is also a tedious chore that requires a lot of time and effort from you and your staff.

To avoid this time-consuming procedure, business owners should obtain the services of a qualified Bookkeeping Accountant like Lanop, that understands your business operations and keeps accurate ledgers and up-to-date records on your behalf.

We eliminates the need to search for an all-encompassing accountancy firm. Our corporate headquarters in London provides practical and efficient solutions to all your accounting needs.

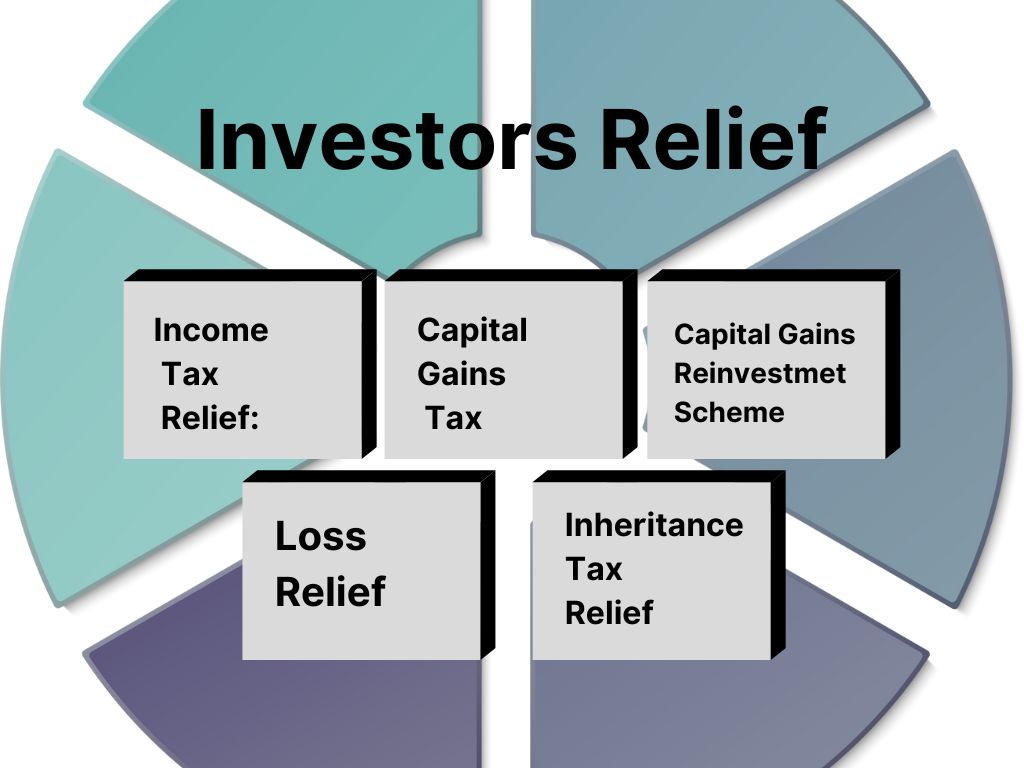

The following relief are available to the investors:

The investors can claim 50% income tax relief on the amount invested (this is the total amount of shares issues to you)

If the investors sell SEIS shares after owning them for 3 years and make a profit on it, they won't have to pay any capital gains tax on the profits. It should be noted that this relief is only available if the shares are held for 3 years.

If the investor made capital gains by selling some other shares and then the gain is reinvested in SEIS shares. 50% of that gain would be exempt from CGT.

If you make a loss on the disposal of your SEIS shares at any time, you can offset this loss against any income or chargeable gains, this will reduce your overall impact.

If you make a loss on the disposal of your SEIS shares at any time, you can offset this loss against any income or chargeable gains, this will reduce your overall impact. If you have invested in SEIS shares and you are not sure how to calculate your loss relief you can contact our accountants at Taxaccolega and our expert team of accountants can help you calculate your loss relief and claim your loss relief.

Investing in SIES shares can be very tax efficient in tax planning. If the SEIS shares are held for 2 years , they may qualify for 100% relief from inheritance tax.

If you need help on how to apply for SEIS income tax relief , please don’t hesitate to contact Taxaccolega and our expert team of income tax accountants in croydon, london will be able to help you.

020 8127 0728

074 7117 0484

info@taxaccolega.co.uk

187a London Road, Croydon, Surrey, CR0 2RJ

Monday — Friday 9:30 am – 5:30 pm

Saturday — Closed

Sunday — Closed

We offer unparalleled tax expertise at Taxaccolega. Our team’s expertise ensures tax compliance and efficiency. Let us guide you through the complexity, providing peace of mind while maximizing your business’s savings.

As an MTD accountancy firm we embrace this new way of handling tax on account to enable several benefits for taxpayers.

Start ups or the early stage companies are able to secure funding through SEIS. The main reason is that SEIS offers tax benefits to the investors. If you are a startup company willing to take higher risks, looking for funding and you qualify for SEIS funding you should definitely consider applying for SEIS . Potential investors are willing to invest in early startup companies because they get generous tax relief and there is a lower risk to them if the company fails.

By securing investment through SEIS the startup companies can have access to the funding in their early stages which can help them cover the initial operational costs, help them with the development costs and expand their market. This will allow them to take risks and help them grow.

First you have to assure that your company qualifies for SEIS . The eligibility criteria of a company applying for SEIS is discussed above.

After you have established that your company qualifies for SEIS funding, you should prepare essential documents such as business plans , financial forecasts and your company structure.

You should gather information on all the planned investments and the expected use of the funds.

You can also apply for advanced assurance by completing an advance assurance form on HMRC’s website and providing supporting documents. The advanced assurance is not compulsory however it is recommended as it boosts the confidence of the investors in the company they are investing in.

Once you have received your investment you should issue shares to your investors within 30 days.

After you have established that your company qualifies for SEIS funding, you should prepare essential documents such as business plans , financial forecasts and your company structure.

You should complete SEIS 1 compliance statement form. This form confirms that you have met all SEIS conditions and have planned to use this investment for qualifying business purposes.

Once HMRC approves the compliance statement form, you will be issued SEIS 3 certificates by HMRC.

These SEIS certificates will help the investors claim their SEIS tax relief on their tax returns.

It's very important that you keep all your related documents safe even after you have issued the shares.

We inform you of:

SEIS is better than the normal loans because they dont require immediate payment. Such an investment is better suited for the start up companies as there is no immediate liability for monthly repayments or interest payments, allowing them to focus on growth and diversity.

If you are an investor and have invested in a SEIS qualified company you should be able to claim SEIS tax relief when you complete your tax return.

The maximum a startup company can receive through SEIS funding is £250 000.

The tax reliefs will be withheld and could potentially be withdrawn if the company does not follow the rules for at least 3 years after the investment is made.

No. If you have received funding through EIS or from venture capital you won’t be able to get more funding from SEIS.

Getting an advanced assurance is recommended but it is not compulsory. It is a process where HMRC will review your company’s details and will confirm if your company is likely to qualify for SEIS. This will give confidence to the investors as well.

020 8127 0728

074 7117 0484

info@taxaccolega.co.uk

187a London Road, Croydon, Surrey, CR0 2RJ

Monday — Friday 9:30 am – 5:30 pm

Saturday — Closed

Sunday — Closed