There can be different reasons as to why you want to close your limited company.This could be because one of the following:

The way you close your limited company depends on whether the company is solvent or not.

HMRC gives us detailed guidance on how we can close a limited company in various circumstances, the costs involved and the accounting responsibilities . In the following blog we have tried to compile some information,

How to close a company if the company cannot pay its bills (Insolvent)

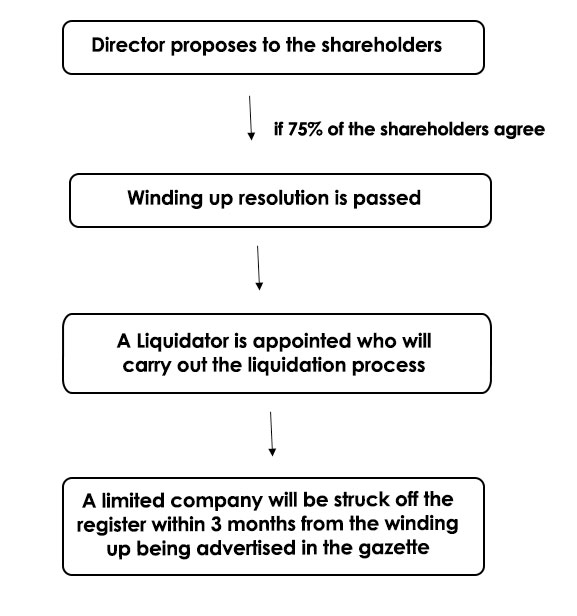

The way to close a limited company which is solvent is to arrange liquidation with your creditors. The director can propose to close the limited company and to initiate the proposal a winding up resolution must be passed.The passing of the resolution means that 75% of the shareholders (by value of shares) has agreed to the winding up process.

Director’s responsibilities:

Once the resolution is made the director should do the following:

Liquidator`s responsibilities

Once the liquidator is appointed the director should hand over all the information related to the company to the liquidator, for example the company’s financial record and all the information related to the assets.

The director can no longer act on behalf of the company and the appointed liquidator will take the responsibility of the company. This means that the liquidator will be responsible to meet the deadlines of all the paperwork and they will be responsible to meet all the accounting and taxation deadlines. The liquidator is supposed to act in the interests of the creditors and they will be involved in the decisions where necessary. The liquidator is expected to set off company assets and pay the money that is owed to the creditor. The final VAT bill will be paid and the company will be removed from the company register.

Compulsory Liquidation:

If your company is unable to pay its bills and you are not able to reach an agreement with the creditors, you can apply to the court for compulsory liquidation. It should be proven to the court that the company cannot pay its debt of £750 or more. And that 75% of the shareholders agree that the company can be wound up by the court. This can be done by filling in the winding up petition and sending it to the court.

If the company is Solvent

If the company is solvent that means it is able to pay its bills but you don’t want to run the company for example you want to retire you have 2 options:

Striking off the company

You can only strike off your company if the following conditions apply:

If the company does not meet the criteria of striking off a limited company can be dissolved by members voluntary liquidation,

Before you apply to strike off the company you should close the company down legally. This involves informing your plans to all the interested parties including HMRC, treating your employees according to the rules and making sure nothing unfair happens to them and dealing with company assets and accounts.

Once this is done the application to strike off should be filled and copies should be sent to anyone who might be a stakeholder for example: members, creditors, employees, any directors who didn’t sign the application.

If you run a limited company and you want professional advice in making accounts, dissolving the company you should contact Taxaccolega and our team of accountants will be happy to help you.

Source: https://www.gov.uk/strike-off-your-company-from-companies-register/close-down-your-company

1,544+

Project Completed

1,822+

Client Satisfaction

190+

Google Reviews

Refer Clients & Earn – Switch Accountant

1,544+

Project Completed

1,822+

Client Satisfaction

190+

Google Reviews

Refer Clients & Earn – Switch Accountant